The 20% Down Payment Myth: What First-Time Buyers in the Twin Cities Need to Know

Saving up to buy a home can feel intimidating—especially right now. And for many first-time buyers, the idea that you must put 20% down can feel like a major roadblock.

But here’s the truth: that’s a common misconception.

Do You Really Have To Put 20% Down?

Unless your specific loan type or lender requires it, you likely won’t need to put 20% down. There are loan options designed to help first-time buyers get in the door with much smaller down payments:

- FHA loans: As low as 3.5% down

- VA and USDA loans: 0% down for qualified applicants, such as Veterans

As The Mortgage Reports puts it:

“. . . many homebuyers are able to secure a home with as little as 3% or even no down payment at all . . . the 20 percent down rule is really a myth.”

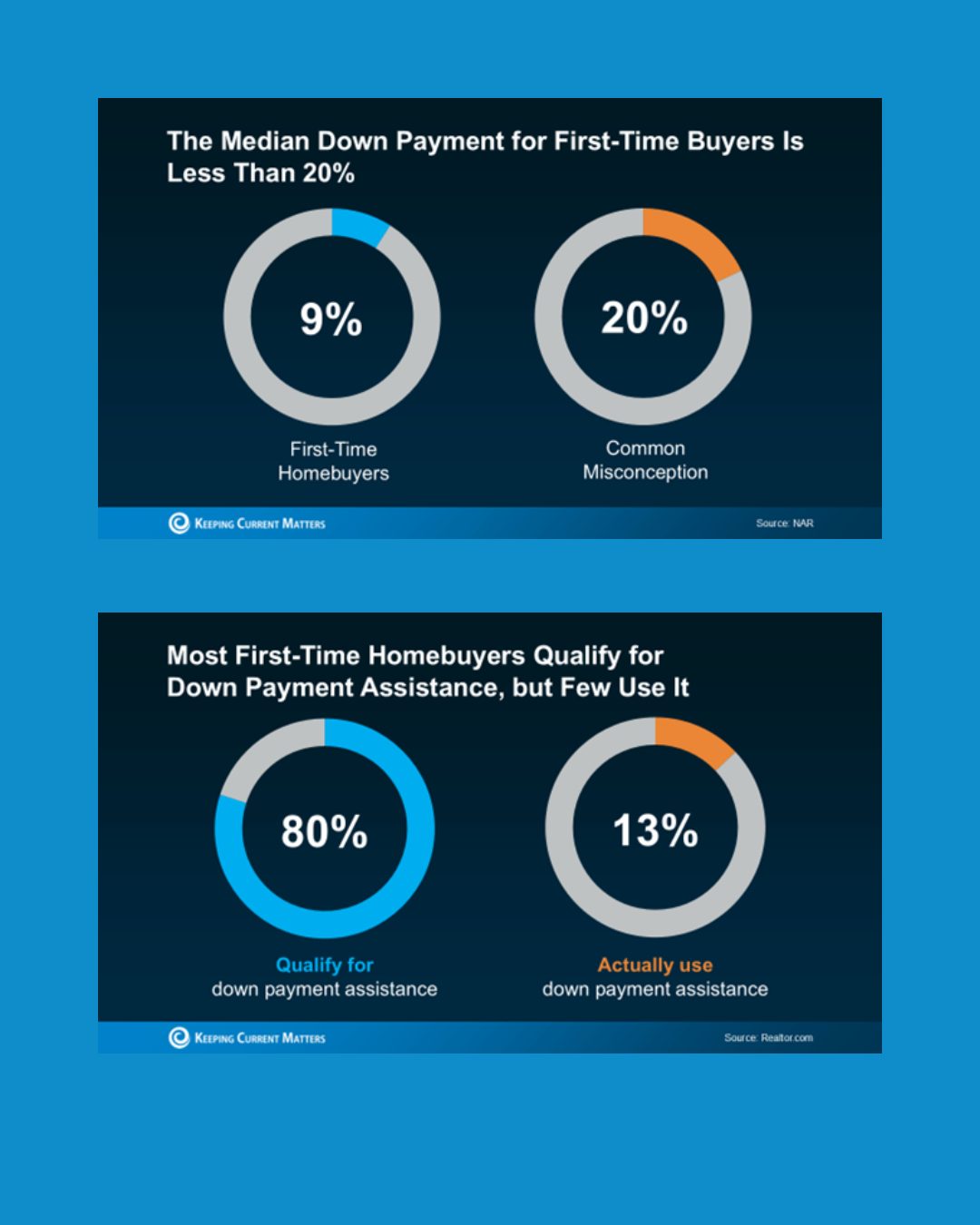

According to the National Association of Realtors (NAR), the median down payment for first-time buyers is just 9%—not 20%.

Why You Should Look Into Down Payment Assistance Programs

Here’s where it gets even better: nearly 80% of first-time buyers qualify for down payment assistance, but only 13% actually use it. That’s a huge missed opportunity.

These programs can offer thousands of dollars in support. According to Down Payment Resource, the average benefit is around $17,000—a serious boost to your homebuying budget.

And in the Twin Cities, there are active programs right now that could help you:

Active Down Payment Assistance Programs in the Twin Cities

Saint Paul – Citywide Downpayment Assistance Program

- Up to $40,000 in assistance through a 15-year deferred loan at 0% interest

- Can be used for down payment, closing costs, or interest rate buydown

- Must earn at or below 80% of Area Median Income (AMI) and have less than $25,000 in non-retirement assets

- Reopening in the first half of 2025—applications will be processed on a first-come, first-served basis [1]

Minneapolis – Minneapolis Homes Financing Program

- Offers funding for affordable homeownership projects, including new construction and rehab

- While primarily for developers, some programs support buyers of city-owned homes or homes built through the program [2]

Minnesota Housing – Start Up and Step Up Programs

- Start Up: For first-time buyers, offers up to $18,000 in down payment and closing cost loans

- Step Up: For repeat buyers or those refinancing, offers up to $14,000

- Loans are deferred or repayable at 0% interest depending on the option chosen [1]

Bottom Line

You don’t need to let the 20% myth hold you back. With low-down-payment loan options and generous assistance programs available across the Twin Cities and Minnesota, homeownership may be closer than you think.

Let’s Make It Happen—Together

As an ABR® (Accredited Buyer’s Representative) designated Realtor, I specialize in helping first-time buyers like you navigate the homebuying process with clarity and confidence. I’ll help you:

- Understand your financing options

- Connect with trusted lenders

- Identify and apply for the right down payment assistance programs

- Find the home that fits your needs and budget

Let’s connect today and take the first step toward making your dream of homeownership a reality—without the 20% stress.

References

[1] Citywide Downpayment Assistance Program – Saint Paul Minnesota

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link